Not known Details About Estate Planning Attorney

Wiki Article

The 45-Second Trick For Estate Planning Attorney

Table of ContentsFascination About Estate Planning AttorneyEstate Planning Attorney Fundamentals ExplainedNot known Incorrect Statements About Estate Planning Attorney Rumored Buzz on Estate Planning Attorney

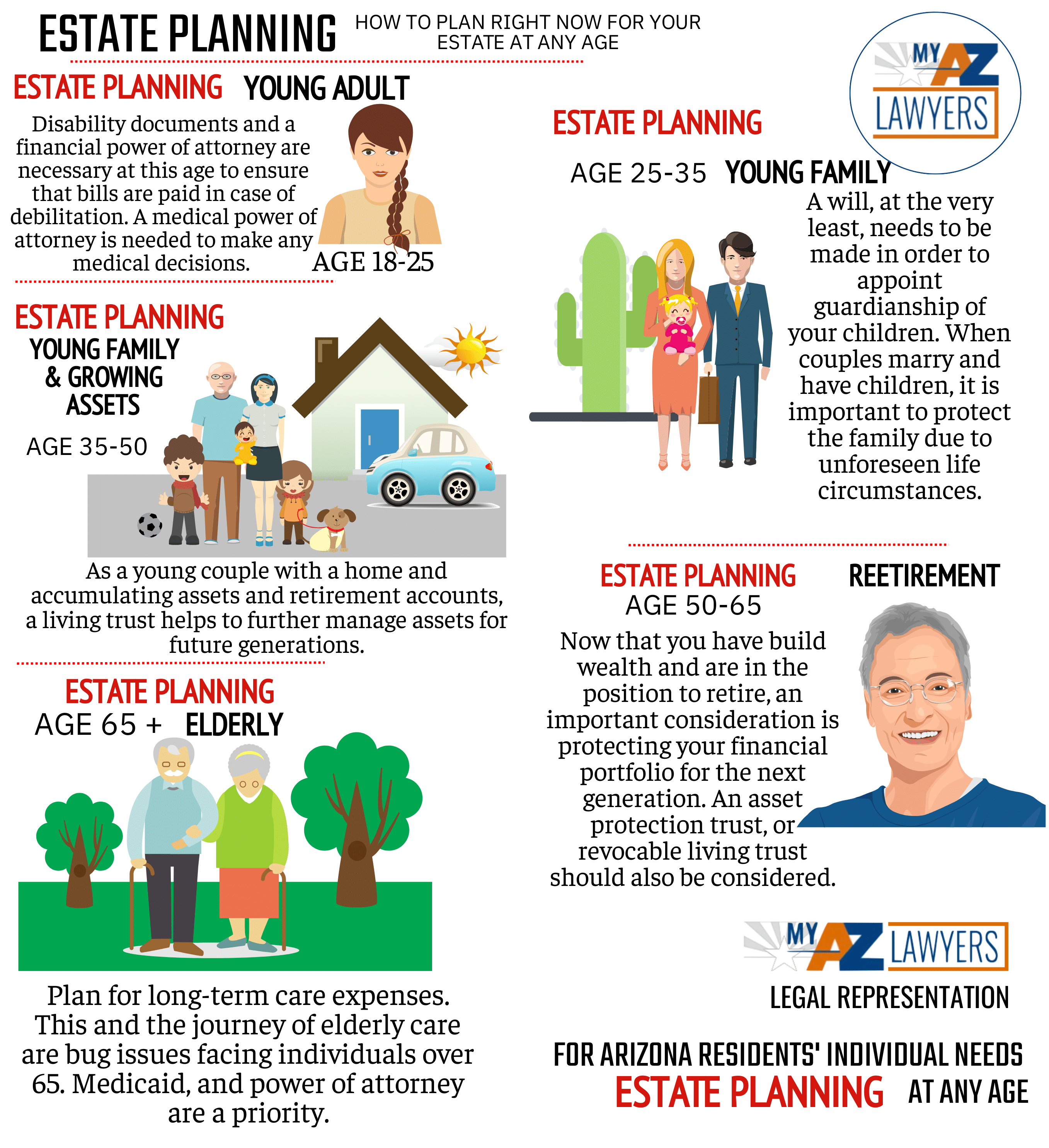

Estate planning is an action strategy you can make use of to determine what occurs to your properties and obligations while you're alive and after you die. A will, on the various other hand, is a lawful document that describes just how properties are distributed, who deals with kids and family pets, and any kind of various other wishes after you die.

Claims that are declined by the administrator can be taken to court where a probate judge will have the last say as to whether or not the claim is valid.

How Estate Planning Attorney can Save You Time, Stress, and Money.

After the inventory of the estate has been taken, the worth of assets computed, and tax obligations and financial debt settled, the administrator will certainly after that look for consent from the court to disperse whatever is left of the estate to the recipients. Any kind of estate tax obligations that are pending will certainly come due within 9 months of the day of fatality.

Each individual locations their properties in the trust fund and names a person various other than their partner as the recipient., to sustain grandchildrens' education and learning.

10 Easy Facts About Estate Planning Attorney Explained

This technique involves cold the worth of a possession at its worth on the date of transfer. As necessary, the amount of possible capital gain at fatality is also iced up, allowing the estate coordinator to approximate their prospective tax obligation liability upon fatality and far better prepare for the settlement of income tax obligations.If sufficient insurance policy proceeds are offered and the plans are correctly structured, any type of income tax on the regarded dispositions of possessions adhering to the death of an individual can be paid without considering the sale of assets. Earnings from life insurance policy that are received by the beneficiaries upon the death of the guaranteed are usually income tax-free.

There are specific papers you'll require as component of the estate preparation procedure. Some of the most usual ones consist of wills, powers of lawyer (POAs), guardianship classifications, and look these up living wills.

There is a myth that estate planning is just for high-net-worth people. But that's not real. Estate planning is a tool that everyone can utilize. Estate preparing makes it easier for people to establish their dreams before and after they pass away. Unlike what many people believe, it prolongs past what to do with possessions and responsibilities.

Not known Incorrect Statements About Estate Planning Attorney

You ought to begin helpful hints planning for your estate as quickly as you have any measurable property base. It's a continuous procedure: as life progresses, your estate strategy should move to match your conditions, in line with your new objectives.Estate planning is typically assumed of as this hyperlink a device for the wealthy. Estate planning is likewise an excellent means for you to lay out strategies for the treatment of your minor children and animals and to describe your desires for your funeral service and favored charities.

Qualified candidates who pass the examination will be officially licensed in August. If you're eligible to rest for the test from a previous application, you may submit the brief application.

Report this wiki page